Understanding the Importance of Budgeting

Budgeting is a crucial skill for teenagers, serving as a foundation for financial success in adulthood. Establishing a budget allows young individuals to track their income and expenses, fostering an understanding of how to allocate their resources effectively. This early exposure is vital for cultivating good financial habits that will last a lifetime. By learning to budget, teenagers gain insights into the relationship between income and expenditure, preparing them for the more complex financial decisions they will face in later years.

One significant benefit of developing budgeting skills is the sense of responsibility that comes with managing personal finances. When teenagers actively engage in budgeting, they learn to prioritize their spending, distinguishing between needs and wants. This ability to make informed decisions enhances their independence, as they become more adept at handling their own financial situations. A well-structured budget not only enables them to save for future goals, such as college or a first car, but also teaches the importance of living within their means.

Furthermore, the practice of budgeting promotes financial literacy. Teens become familiar with essential concepts such as saving, investing, and debt management, equipping them with the knowledge needed to navigate the complex financial landscape of adulthood. By understanding the importance of budgeting, they are better prepared to tackle challenges such as student loans, credit cards, and unforeseen expenses that may arise. Ultimately, budgeting empowers teenagers to take charge of their financial futures, instilling habits that will contribute to their overall wellbeing and success as adults.

Setting Financial Goals

Establishing financial goals is a crucial first step for teenagers who wish to manage their finances effectively. By identifying clear short-term and long-term objectives, teens can develop a roadmap that turns their aspirations into achievable plans. Understanding the significance of such goals not only helps in budgeting but also fosters a sense of responsibility and empowerment over one’s financial future.

Short-term goals, which cover aims typically reachable within a year, can include saving for a new phone, a gaming console, or funds for an upcoming trip. These goals must be specific, measurable, achievable, relevant, and time-bound (SMART). For instance, instead of vaguely aiming to “save money,” a teen could set a target to save $300 over the next six months to purchase a new laptop. This specificity allows for more focused and motivated saving efforts.

On the other hand, long-term financial goals can span several years and might include aspirations like funding a college education or saving for a vehicle. It is essential for teenagers to articulate why these goals matter to them. This deeper understanding can strengthen their commitment to achieving them. For instance, knowing that college education will shape their career can enhance their resolve to save diligently over the years.

In helping teens define their financial goals, parents and mentors can offer guidance through discussions and practical exercises. This might involve brainstorming sessions where teens can list their desires and then prioritize them based on importance and feasibility. With a clear set of short-term and long-term goals in place, teens can design a budget that actively supports their financial ambitions, ultimately leading toward greater financial literacy and independence.

Income Sources for Teens

Understanding income sources is crucial for teenagers looking to develop a comprehensive budget. As many teens begin to explore personal finance, recognizing the variety of ways to earn money can significantly impact their budgeting journey. Common income sources for teenagers typically include part-time jobs, allowances from parents, and freelance gigs.

Part-time jobs are perhaps the most traditional route for teens to earn money. Many high school students work in retail, food service, or other fields that offer flexible schedules. These jobs not only provide a reliable income, but they also foster essential skills such as time management, responsibility, and interpersonal communication. When considering a part-time job, it’s important for teens to calculate their total income based on hourly wages and weekly hours worked. This information is foundational when they start creating a budget that reflects their earning capacity.

Another common source of income for teenagers is the allowance provided by parents. This financial support can vary widely, but it often serves as a tool for teaching young people about money management. It is beneficial for teens to view their allowance as part of their total income. Understanding how much they receive regularly from their parents can help them plan their budgets more effectively, especially when it comes to discretionary spending.

Freelancing and gig economy work have also gained popularity among teenagers. Platforms that offer creative or manual tasks allow teens to leverage their skills to earn extra cash. These gigs can range from babysitting and lawn care to graphic design and social media management. For many teenagers, freelance work provides a flexible income source that can be tailored to their schedules and interests. Accurately assessing this income is vital for building a realistic budget.

Overall, teenagers should take the time to identify and calculate their total income from various sources. This understanding lays the groundwork for developing a practical and effective budget that aligns with their financial goals.

Tracking Expenses

Effective tracking of expenses is a critical skill for teens who are beginning to learn about budgeting. Understanding one’s spending habits allows for more informed financial decisions, ensuring that they remain within their allocated budget. There are several methods and tools available to assist teenagers in monitoring their expenditures. One of the most popular modern approaches is the use of budgeting apps. These apps can simplify the tracking process by allowing users to categorize their purchases, set spending limits, and analyze patterns in their financial behavior. Commonly used budgeting apps include Mint, YNAB (You Need A Budget), and PocketGuard, each of which offers unique features tailored to different financial needs.

For those who prefer a more traditional method, utilizing a spreadsheet can also be effective. Programs such as Microsoft Excel or Google Sheets enable users to create a customized budget template, listing income, fixed costs, and discretionary spending. By consistently updating the sheet with daily expenses, teens can gain a clearer picture of their financial status. Additionally, this method encourages them to actively engage with their budget on a regular basis.

It is essential for teens to be mindful of small purchases that can quickly add up, often leading to budget shortfalls. Subscriptions, snacks, and spontaneous buy can contribute significantly to overspending. By tracking these minor expenditures, young individuals can better comprehend their financial landscape and make informed adjustments. Keeping receipts or logging transactions in real time can aid in this regard, providing a clearer trail of where their money is going. Overall, regardless of the method chosen, maintaining an accurate record of expenses is fundamental to developing healthy financial habits that will serve them well into adulthood.

Creating a Realistic Budget

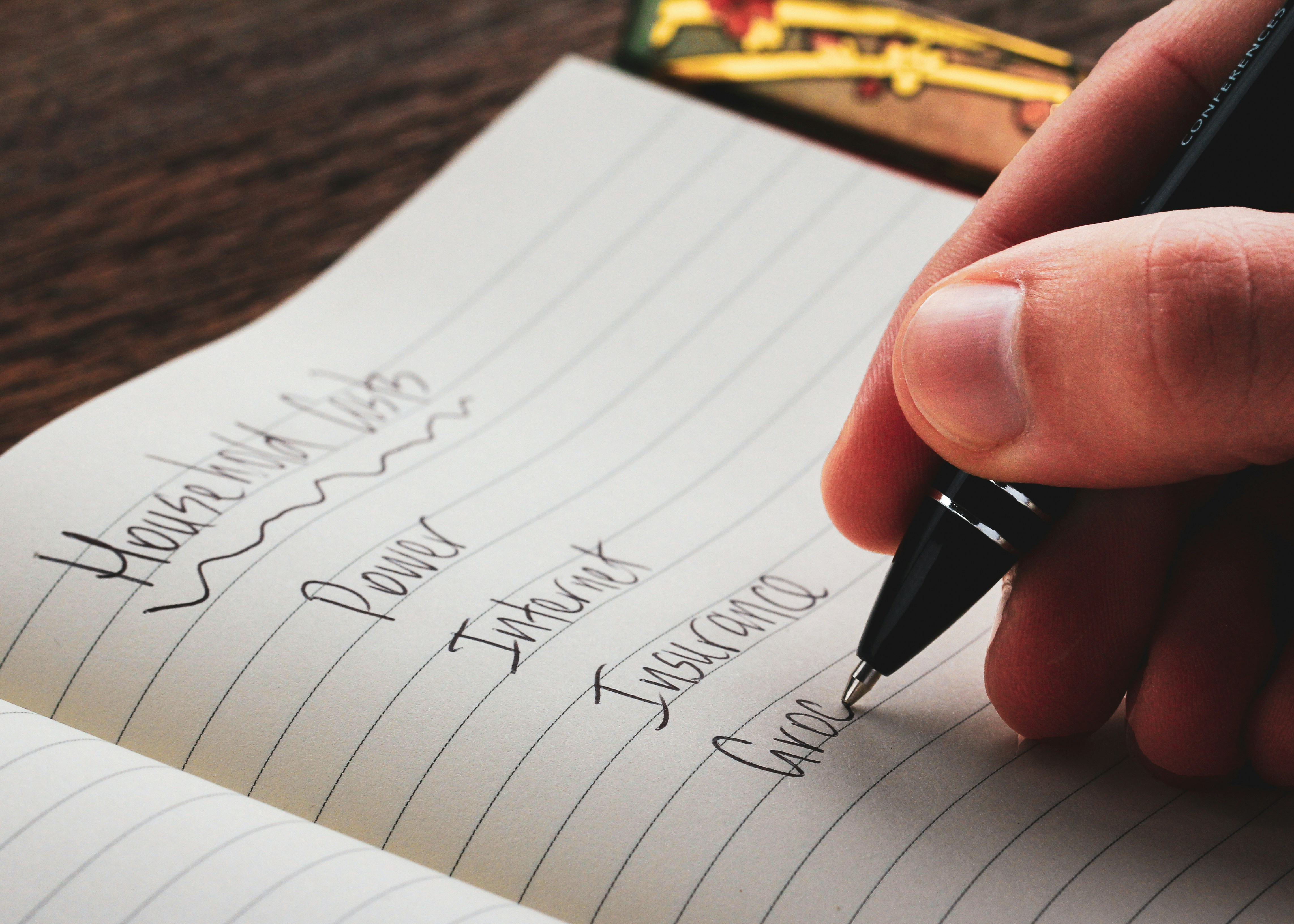

Creating a realistic budget is a crucial first step towards achieving financial independence and responsible money management for teenagers. To begin, teens should calculate their total monthly income, which can stem from various sources such as allowances, part-time jobs, or gifts. Once the total income is established, it is essential to list all regular expenses. This includes fixed costs, such as subscriptions, phone bills, and transportation, alongside variable expenses like entertainment, dining out, and shopping.

Next, categorize these expenses into two main groups: necessities and wants. Necessities are essential for daily living, while wants are discretionary and can often be postponed. This categorization allows adolescents to prioritize their spending effectively. For instance, a basic budget structure could include sections for housing (if applicable), food, entertainment, savings, and miscellaneous costs.

Once the necessary expenses are identified, allocate specific amounts of income to each category. It can be helpful to apply the 50/30/20 rule, where 50% of income goes to needs, 30% to wants, and 20% to savings. However, teens should customize their budget based on individual circumstances and goals. Moreover, it is prudent to always leave a buffer for unexpected expenses that may arise during the month.

Utilizing simple budget formats, such as a spreadsheet or budgeting apps geared toward young users, can aid in tracking incomes and expenses easily. Regularly reviewing and adjusting the budget will ensure that it remains realistic and reflects any changes in lifestyle or goals. By following these steps, teens can develop a functional budgeting approach that promotes savings and responsible spending.

Adjusting Your Budget as Needed

Creating a budget is often perceived as a one-off task; however, in reality, it is a dynamic process that requires ongoing adjustments. One of the primary reasons for adjusting a budget is a change in income. This can occur for various reasons, such as getting a part-time job, losing a source of income, or receiving a raise. With fluctuations in income, it is crucial to revisit and modify the budget accordingly to ensure expenses remain manageable.

In addition to changes in income, unexpected expenses can significantly impact a budget. These may arise from unforeseen circumstances, such as medical emergencies, car repairs, or increased living costs. When faced with these expenses, it is essential to re-evaluate spending habits. Creating a buffer within the budget for such occurrences can alleviate some stress, but if they happen frequently, rethinking the overall budget becomes necessary.

Strategies for regularly reviewing and modifying budgets can help make this process smoother. One effective approach might include setting specific dates each month to examine and adjust your budget. During these reviews, consider tracking your actual spending against your projected expenses, identifying patterns, and acknowledging areas where expenditures can be reduced or eliminated. Additionally, tools like budgeting apps or spreadsheets can provide insights into spending habits and help visualize financial health more clearly.

Furthermore, it is crucial to remain flexible in one’s approach to budgeting. Life events, such as starting college or taking on new responsibilities, can necessitate significant shifts in your financial priorities. Adapting your budget to accommodate these life changes allows for better financial stability and helps ensure that your budgeting process remains effective and relevant over time. Regular adjustments not only reflect real-life financial situations but also promote a more accurate representation of one’s financial goals.

The Role of Saving and Emergency Funds

Saving money is a fundamental aspect of financial management that every teen should prioritize. It lays the groundwork for achieving financial goals, whether it’s buying a new gadget, funding a project, or preparing for future expenses. Among the various saving methods, creating an emergency fund holds particular significance. An emergency fund is a financial safety net that enables individuals to cover unexpected expenses such as medical bills, car repairs, or sudden job loss without resorting to credit cards or loans.

Establishing an emergency fund is crucial for enhancing financial security. It not only prevents financial distress during unexpected situations but also promotes a sense of stability and confidence in managing personal finances. For teens, this means taking proactive steps to save a portion of any allowance, gift money, or earnings from part-time jobs. By designating funds for emergencies, teens cultivate responsible financial habits from an early age.

Even when navigating a tight budget, building savings is achievable. Here are a few strategies to help teens prioritize saving despite limited resources. First, consider setting a specific savings goal. This goal should be realistic and measurable—whether it’s aiming for a specific dollar amount or saving for a particular event. Next, create a dedicated savings account to differentiate between regular spending and savings. Many banks offer youth accounts with no fees, making them a suitable option for teens.

Moreover, adopting the habit of saving small amounts regularly can yield significant results over time. Teens might consider the 50/30/20 rule as a guiding principle: allocate 50% of income to needs, 30% to wants, and 20% to savings. By consistently setting aside money, no matter how small the amount, teens will be better prepared for emergencies and instill a prudent approach to financial management that can benefit them throughout their lives.

Avoiding Common Budgeting Mistakes

Creating a budget is an essential life skill for teens, yet many encounter common pitfalls that can undermine their financial efforts. One prevalent mistake is underestimating expenses. Teens might overlook regular expenditures such as school supplies, transportation costs, or even leisure activities. It is crucial for young budgeters to adopt a comprehensive approach by recording all potential costs in their monthly budget. This includes fixed expenses, like subscriptions, as well as variable costs related to social outings. By being thorough, they will gain a clearer picture of their financial landscape, reducing the chances of overspending.

Another frequent misstep is overestimating income. Teens may not be accustomed to handling irregular income streams that fluctuate based on part-time job hours or odd jobs. A effective budgeting strategy would involve calculating an average monthly income based on realistic projections rather than optimistic estimates. This accuracy allows for more informed planning and aids in cushioning against any unexpected financial shortfalls.

Neglecting to track discretionary spending is another common oversight. It can be all too easy to miss the impact that small purchases, such as snacks or app downloads, can have on overall finances. Implementing a logging system can help in tracking these expenses, empowering teens to identify where their money goes and make informed decisions regarding unnecessary expenditures. Techniques such as a spending diary or budgeting apps can serve this purpose effectively.

By understanding and addressing these common budgeting mistakes, teens can enhance their financial literacy and develop sustainable budgeting habits. Avoiding these pitfalls is essential in ultimately creating a budget that works and fosters their confidence in managing personal finances responsibly.

Using Technology to Your Advantage

In today’s digital age, technology plays a significant role in simplifying the budgeting process. For teens, several budgeting apps and online tools are available that can help manage their finances more effectively. These applications range from basic expense trackers to comprehensive budgeting systems, catering to diverse needs and preferences.

One of the most popular tools among tech-savvy individuals is Mint. This free app allows users to link their bank accounts, categorize spending, and set financial goals. Mint’s automated feature can generate a snapshot of one’s financial health, making it easy to understand where one’s money is going. Another excellent option is You Need a Budget (YNAB), which operates on the principle of proactive planning. YNAB encourages users to allocate every dollar they earn towards specific expenses or savings, promoting a disciplined approach to budgeting.

For those looking for a more minimalist interface, GoodBudget offers an envelope budgeting system, where users can create virtual envelopes for various spending categories. This feature is particularly beneficial for teens who prefer a visual representation of their finances. Additionally, EveryDollar provides a user-friendly budgeting experience that emphasizes tracking expenses straight from a simple dashboard.

When selecting an appropriate budgeting tool, teens should consider their personal preferences, such as whether they appreciate visual graphs, desire mobile compatibility, or require reminders for bill payments. Some students might find they prefer a hands-on approach with spreadsheets in applications like Google Sheets or Excel, which offer flexibility and customization options tailored to individual needs.

Ultimately, leveraging technology to create and manage a budget can lead to better financial understanding and discipline. By choosing the right budgeting app or tool, teens can establish healthier financial habits that serve them well into adulthood.